Matchless Tips About How To Lower Tax Debt

How to settle tax debt step by step first, you apply for an offer in compromise (oic) using form 656.

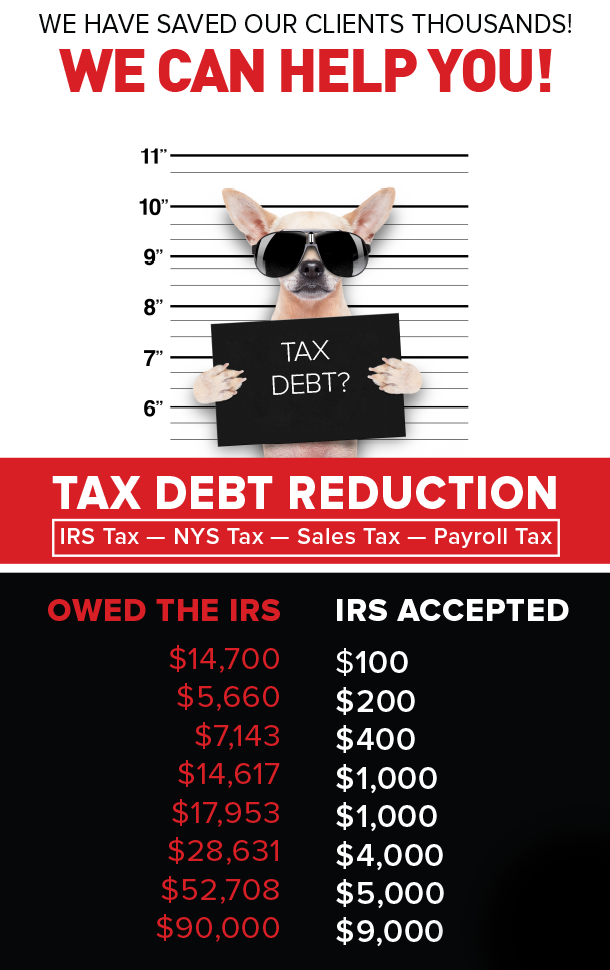

How to lower tax debt. The truth is third parties can't always deliver on claims to reduce tax debt and obtain waivers of penalties and interest. The oic program is an irs program that allows taxpayers unable to pay their tax liability in total to settle their debt for less than the full amount owed. Whether you didn’t pay last year or you haven’t paid for the last five years, the irs won’t.

An offer in compromise allows you to settle your tax debt for less than the full. Before you apply, you must make federal tax deposits for the current and past 2 quarters. Don't wait until its too late

Debt settlement is an agreement between the creditor and the borrower. Ad end your irs tax problems. One way to do this is by lowering your adjusted gross.

Tax debt (often called back taxes) is any money you owe the government in unpaid taxes. Both parties agree on a reduced amount to pay off the debt in full. [ see all options ]

Ad end your irs tax problems. When you’re filing your taxes each year, the amount you owe is due upon filing. Make sure you really owe the money.

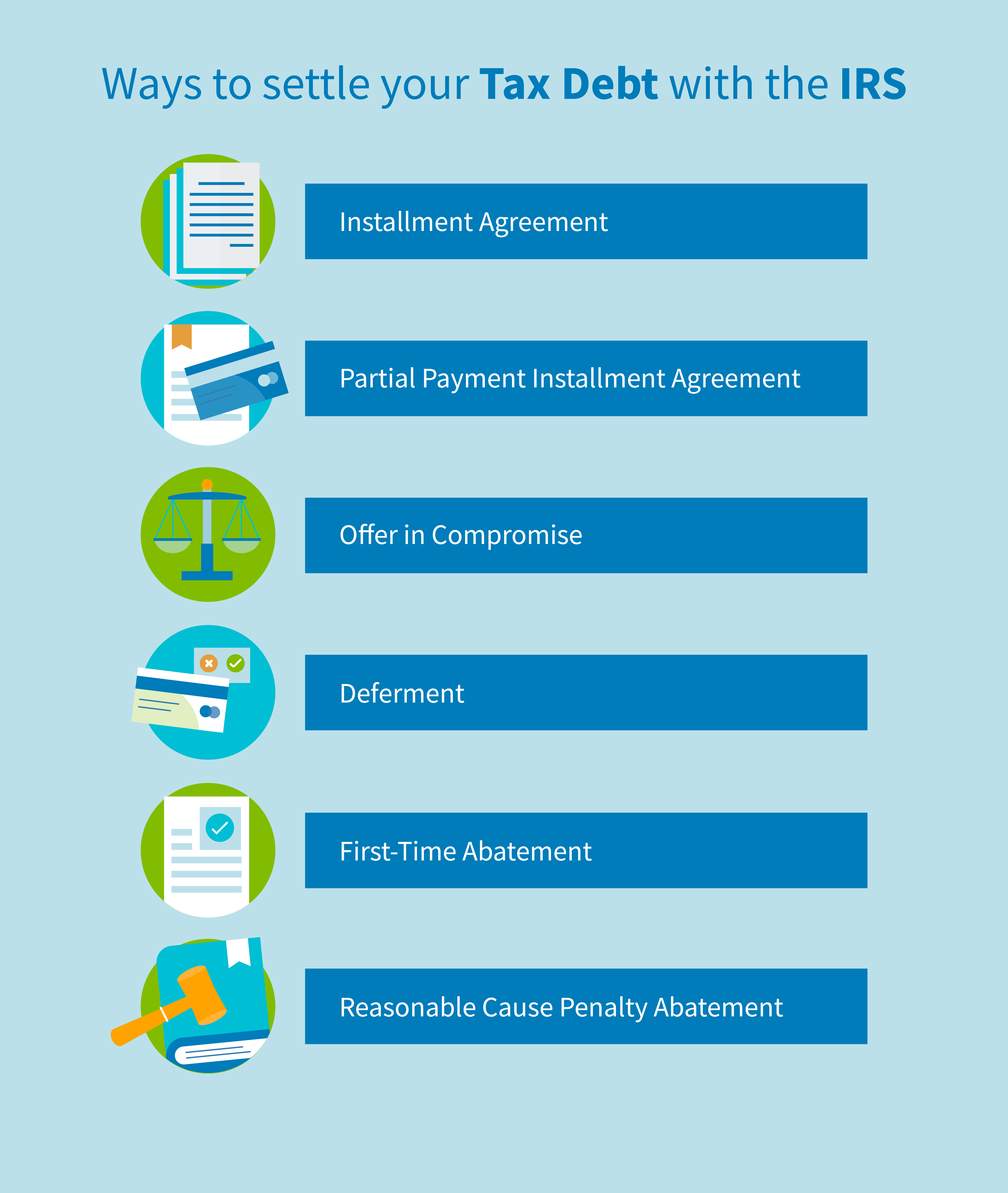

How to lower your tax debt negotiating a fair installment agreement. Lower and potentially eliminate your tax debt with the following programs. Ad reduce debt with best bbb accredited debt relief programs.